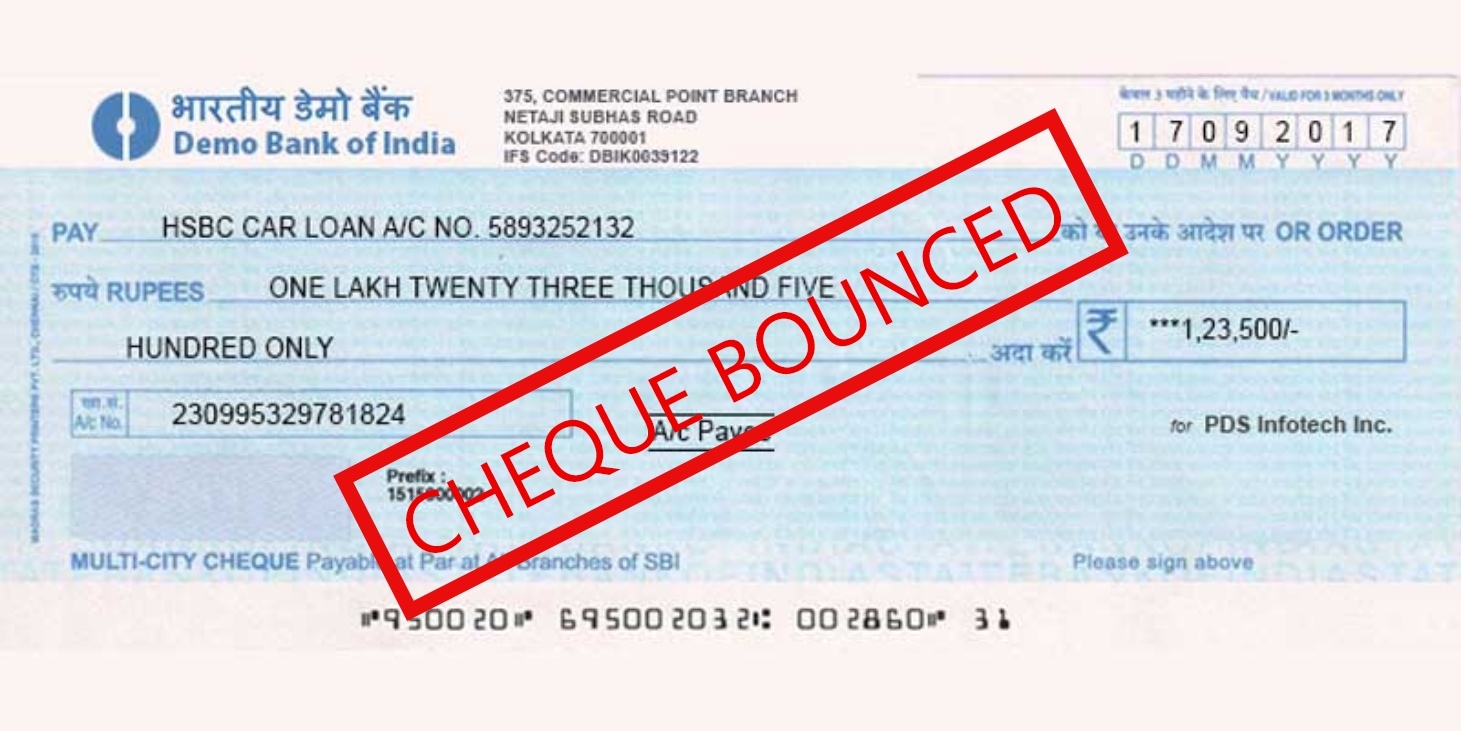

Check Bounce

A cheque bounce occurs when a cheque presented for payment is returned by the bank unpaid due to insufficient funds in the issuer's account or other reasons like a mismatched signature. Under Section 138 of the Negotiable Instruments Act, 1881, issuing a cheque that bounces can lead to legal consequences, including criminal prosecution.

Legal Implications of a Cheque Bounce If a cheque you issued or received bounces, it’s important to understand the legal implications:

- Criminal Liability: The issuer of the bounced cheque can face criminal charges under Section 138 of the Negotiable Instruments Act, which can result in fines and imprisonment for up to two years.

- Civil Remedies: The payee can file a civil suit to recover the amount of the bounced cheque, along with compensation for any losses incurred due to the dishonor.

Steps to Take in a Cheque Bounce Case

- Notice of Dishonor: The payee must send a legal notice to the issuer within 30 days of the cheque being returned, demanding payment of the amount within 15 days.

- Filing a Complaint: If the issuer fails to make the payment within the stipulated time, the payee can file a complaint in the appropriate court within 30 days from the expiry of the notice period.

- Court Proceedings: The court will examine the evidence and, if satisfied that the cheque was indeed dishonored, may impose penalties, including imprisonment and fines.

Why Choose Advocate Ji?

Our team of experienced legal professionals is dedicated to handling cheque bounce cases with the utmost diligence and expertise. We provide comprehensive legal support, from drafting legal notices to representing clients in court, ensuring that your financial rights are upheld.